For many Singaporeans, the decision between buying a condo and waiting for a Build-To-Order (BTO) flat is a significant one. This article explores the key considerations, financial implications, and strategic factors involved in buying a condo before applying for a BTO flat.

Key Considerations

Eligibility and Age Requirements

To purchase a condominium in Singapore, you must be at least 21 years old.

Financial Considerations

Downpayment

You will need at least 5% of the purchase price as a downpayment if you don’t have any existing mortgage property loans.

Stamp Duties

Be prepared to pay the Buyer’s Stamp Duty (BSD) and, if applicable, the Additional Buyer’s Stamp Duty (ABSD).

Loan Approval

Ensure you have an Approval-in-Principle (AIP) from a bank to understand your loan eligibility and avoid financial pitfalls.

Process and Timeline

The process of buying a condo can be expedited to as short as 28 days with proper planning and assistance from an experienced agent. Critical steps include:

- Getting mortgage pre-approval

- Preparing necessary documents

- Securing the Option to Purchase (OTP)

Impact on BTO Eligibility

Eligibility Criteria for BTO

To apply for a Build-To-Order (BTO) flat, you must not own any private residential property (locally or overseas) and must not have sold any private residential property within the last 30 months. If you buy a condo first, you will become ineligible to apply for a BTO flat until you meet the 30-month waiting period after selling the condo.

Housing Subsidies

If you have previously enjoyed any housing subsidies (e.g., buying a flat from HDB, resale flat with CPF grant, or Executive Condo from a developer), you may face restrictions or be ineligible for further subsidies when applying for a BTO flat.

Strategic Considerations

Investment vs. First Home

If you are considering a condo as an investment property, be aware that this will affect your eligibility for future BTO applications and housing subsidies. Condos generally offer greater flexibility and amenities but come with higher costs compared to HDB flats.

Long-term Planning

Consider your long-term housing needs and financial situation. If you plan to settle in a BTO flat eventually, it may be more prudent to apply for a BTO first to take advantage of government subsidies and lower costs.

Comparison of Affordability: Condo Market vs. BTO Market

Build-To-Order (BTO) Flats

Affordability Factors

- Price Range: BTO flats are significantly more affordable compared to private condos. Recent BTO launches in various districts show prices ranging from:

- 2-room Flexi flats: $84,000 to $284,000

- 3-room flats: $202,000 to $300,000

- 4-room flats: $300,000 to $400,000

- 5-room flats: $400,000 to $600,000

- Government Subsidies: BTO flats benefit from substantial government subsidies, making them more accessible to first-time homebuyers. Additionally, eligible buyers can receive CPF Housing Grants to further reduce the financial burden.

- Loan and Financing: HDB loans for BTO flats offer favorable terms, including up to 80% Loan-to-Value (LTV) ratio, lower interest rates (typically 2.6% per annum), and longer loan tenures (up to 25 years).

Eligibility and Restrictions

BTO flats are subject to eligibility criteria, including citizenship, family nucleus, and income ceiling (usually $14,000 per month for families). There is also a Minimum Occupation Period (MOP) of five years before the flat can be sold.

Private Condominiums

Affordability Factors

- Price Range: Condominiums are generally more expensive than BTO flats. The median price of a new launch condo was around S$1.95 million in 2022, while resale condos were approximately S$1.39 million.

- Loan and Financing: Financing for condos involves up to 75% Loan-to-Value (LTV) ratio for bank loans, higher interest rates compared to HDB loans (around 4% per annum), and loan tenures up to 30 years.

- Additional Costs: Condo buyers must also account for BSD and potentially ABSD if they own other properties, higher maintenance fees, and property taxes.

Flexibility and Amenities

Condos offer greater flexibility in terms of ownership and rental income potential. They also provide luxurious amenities such as swimming pools, gyms, and security services.

Affordability Comparison

| Aspect | BTO Flats | Private Condominiums |

|---|---|---|

| Price Range | $84,000 to $600,000 | $1.39 million to $1.95 million |

| Government Subsidies | Yes | No |

| Loan Terms | Up to 80% LTV, 2.6% interest, 25 years | Up to 75% LTV, ~4% interest, 30 years |

| Eligibility | Strict criteria (citizenship, income) | More flexible, but higher financial requirements |

| Additional Costs | Lower (no ABSD, lower maintenance) | Higher (BSD, ABSD, maintenance fees) |

| Amenities | Basic | Luxurious (pools, gyms, security) |

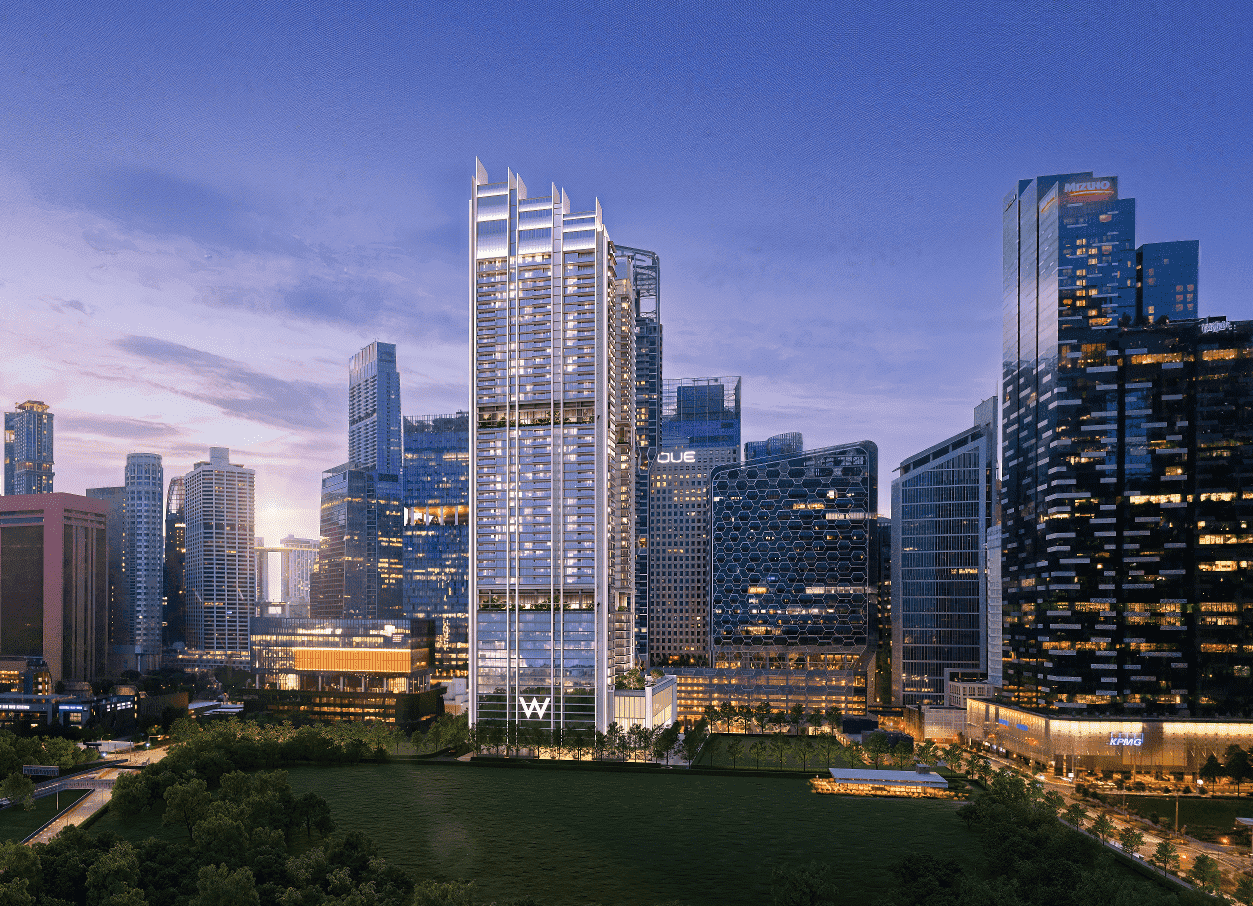

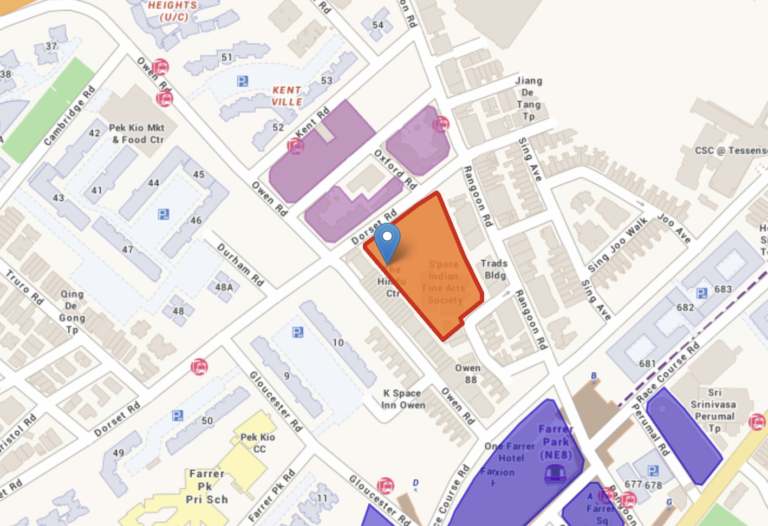

upcoming Condos

Hurry—prime units vanish fast! Secure your showflat appointment now!

Conclusion

Buying a condo before applying for a BTO flat in Singapore involves careful consideration of eligibility criteria, financial commitments, and long-term housing plans. While condos offer immediate possession and luxurious amenities, they may affect your eligibility for future BTO applications and housing subsidies. Ensure you understand all implications and plan accordingly to make the best decision for your housing needs.