When it comes to property investment in Singapore, understanding the appreciation potential of different types of properties is crucial. For many Singaporeans, the choice often boils down to Housing and Development Board (HDB) flats and private condominiums (condos).

Both have their own sets of advantages and limitations, but how do they compare in terms of appreciation? Let’s dive into the details.

Understanding Property Appreciation

Property appreciation refers to the increase in the value of a property over time. This can be influenced by various factors including location, market demand, economic conditions, and government policies. For homebuyers and investors, higher appreciation rates can translate into greater returns on investment.

HDB Flats: Steady but Moderate Growth

HDB flats are the backbone of public housing in Singapore, providing affordable housing options for the majority of Singaporeans. Here’s how HDB flats have fared in terms of appreciation:

Historical Performance

- Past Trends: Over the past four years, median resale HDB prices have shown steady growth. Notably, in 2020 and 2021, HDB resale prices outpaced the growth of both median resale and new private home prices.

- Recent Slowdown: However, this growth experienced a slowdown in 2022 and 2023 due to increased price resistance and the implementation of cooling measures, such as tighter HDB loan restrictions and a 15-month wait-out period for private homeowners purchasing HDB resale flats without housing grants.

Factors Influencing HDB Appreciation

- Government Policies: Policies allowing greater use of Central Provident Fund (CPF) for resale flat purchases and increased HDB resale transactions have contributed to price growth.

- Market Dynamics: Shifts from buying Build-To-Order (BTO) flats to the resale market and condo owners downgrading to resale flats have also played pivotal roles.

Condos: Higher Appreciation Potential

Private condominiums, while more expensive, offer several advantages that can lead to higher appreciation rates:

Historical Performance

- Stronger Growth: Resale condo prices have shown robust increases, with an 11.1% rise in 2022 and a 10.7% rise in 2023, surpassing the growth in resale HDB prices.

- Long-Term Trends: Over the past 20 years, condo prices have more than tripled, compared to HDB prices which have doubled. This widening price gap highlights the stronger appreciation potential of condos.

Factors Influencing Condo Appreciation

- Market Demand: Condos are often seen as more desirable due to their amenities, security, and status symbol. This higher demand can drive up prices.

- Investment Potential: Condos are also favored for their investment potential. They can be rented out more easily, providing a steady income stream for owners.

Comparative Analysis: HDB vs Condo

To provide a clearer picture, let’s compare the appreciation potential of HDB flats and condos based on several key factors:

| Factor | HDB Flats | Condos |

|---|---|---|

| Historical Appreciation | Steady growth, with recent slowdowns due to cooling measures | Strong, consistent growth, especially in recent years |

| Government Influence | Subject to various government policies and restrictions | Less influenced by government policies, more driven by market demand |

| Market Dynamics | Influenced by shifts in BTO vs resale market and downgrading trends | Driven by investment potential and desirability of amenities |

| Price Quantum | Lower overall price quantum, resulting in smaller capital appreciation | Higher price quantum, leading to larger capital appreciation |

| Affordability | More affordable, with various grants and subsidies available | Higher initial cost, with additional costs for amenities and maintenance |

| Investment Potential | Limited rental potential due to restrictions on renting out entire units | Higher rental potential, making them attractive for investment |

| Cooling Measures Impact | More susceptible to cooling measures, which can slow down appreciation | Less impacted by cooling measures, with continued strong demand |

Conclusion: Which is the Better Investment?

The decision between investing in an HDB flat or a condo ultimately depends on your financial situation, investment goals, and lifestyle preferences.

HDB Flats

- Pros: More affordable, various grants and subsidies, stable appreciation.

- Cons: Lower appreciation potential, subject to government policies, limited rental potential.

Condos

- Pros: Higher appreciation potential, greater investment opportunities, desirable amenities.

- Cons: Higher initial cost, additional costs for maintenance and amenities, less government support.

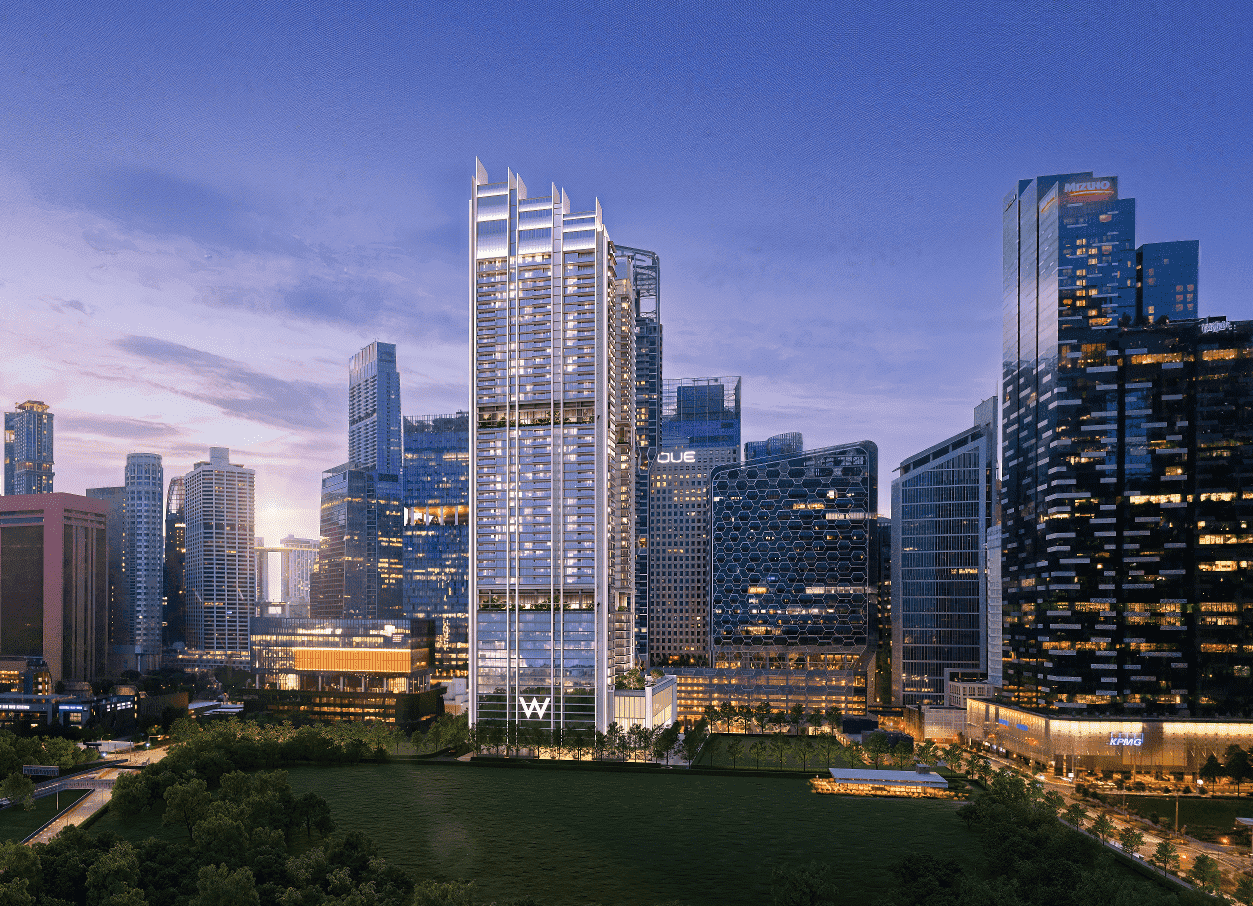

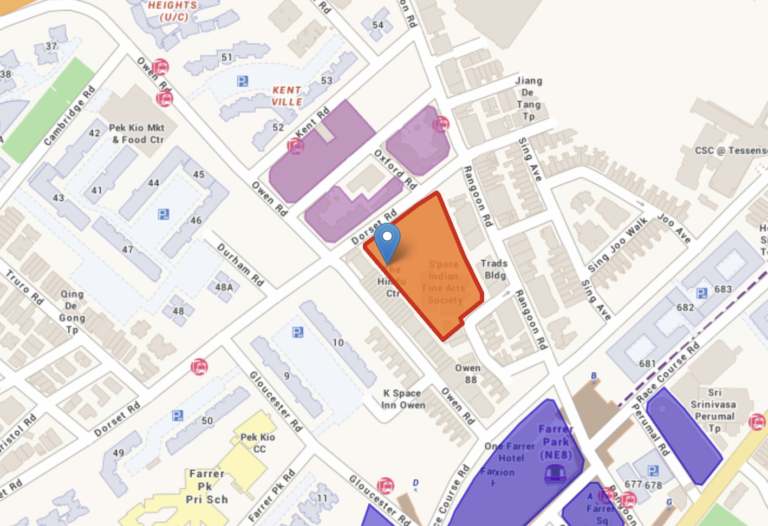

upcoming Condos

Hurry—prime units vanish fast! Secure your showflat appointment now!

Final Thoughts

For those seeking steady, long-term growth with lower initial costs, HDB flats may be the way to go. However, if you have the financial capacity and are looking for higher returns and greater investment potential, condos could be a more lucrative option.

As always, it’s important to consider your personal financial situation and long-term goals before making a decision. Consulting with a property expert can also provide valuable insights tailored to your specific needs. Whether you choose an HDB flat or a condo, understanding the appreciation potential and market dynamics will help you make an informed investment decision.