In Singapore, the property landscape is unique, particularly when it comes to owning both an HDB flat and a private condominium. Married couples looking to navigate these waters must understand the regulations and requirements involved.

This guide will provide you with the essential information needed to make informed decisions about property ownership.

Understanding HDB Flats and Private Condominiums

What is an HDB Flat?

The Housing and Development Board (HDB) is Singapore’s public housing authority, providing affordable housing to citizens. HDB flats are subsidized homes and come with certain conditions regarding ownership and resale.

What is a Private Condominium?

Private condominiums offer more flexibility in terms of ownership and amenities compared to HDB flats. These properties are typically more expensive and cater to a different demographic in the housing market.

Key Conditions for Owning Both Properties

1. Minimum Occupation Period (MOP)

Before purchasing a private condominium, the couple must fulfill the Minimum Occupation Period (MOP) for their HDB flat. Here are the key points:

- The MOP is typically five years from the date of key collection.

- During this period, the HDB flat cannot be sold or rented out entirely.

- It’s important to keep in mind that the couple must not purchase any private property until the MOP is fulfilled.

2. Ownership Structure

The ownership structure is crucial for married couples wanting to own both properties:

- One spouse can be listed as the owner of the HDB flat, while the other can be an occupier.

- This structure allows the occupier spouse to purchase a private property without incurring Additional Buyer’s Stamp Duty (ABSD) on a second home.

3. Citizenship Requirements

Only Singapore Citizens can own both an HDB flat and a private condominium at the same time. Here’s what you need to know:

- Singapore Permanent Residents (PRs) must sell their HDB flat within six months of purchasing a private property.

- If both spouses are citizens, they can proceed with owning both types of properties under the right conditions.

Financial Considerations

Owning multiple properties comes with financial implications:

- Costs of Maintenance: Be prepared for the ongoing costs associated with maintaining two properties.

- Taxes and Duties: Understand the tax implications, especially if ABSD applies.

Understanding Additional Buyer’s Stamp Duty (ABSD)

ABSD is a critical factor in property purchases:

- Singapore Citizens pay 20% ABSD on their second property and 30% on subsequent properties.

- PRs pay 5% ABSD on their first property, 30% on their second, and 35% on any additional properties.

- Foreigners face a staggering 60% ABSD on all property purchases.

Strategies to Mitigate ABSD

To avoid or minimize ABSD, consider these strategies:

- Decoupling: Transfer ownership of a jointly owned property to one party, allowing the other to buy a new property without incurring ABSD.

- 99-1 Ownership Split: One spouse owns 99% of the property while the other owns 1%. This allows the minor owner to relinquish their share, helping avoid ABSD.

- Property Trusts: Consider purchasing property under a trust for children below 21 to manage taxes better.

Regulatory Compliance

Compliance with HDB regulations is crucial:

- Always stay updated with HDB rules regarding ownership and residency.

- Seek professional advice if unsure about specific circumstances or regulations.

Penalties for Violating Property Ownership Restrictions

Ignoring property ownership laws can lead to severe consequences:

For HDB Flats

- MOP Violations: Failing to occupy during the MOP can lead to compulsory acquisition of the flat.

- Financial Penalties: Breaching MOP rules can result in fines up to S$50,000.

- Unauthorized renting or selling can also lead to similar penalties.

For Private Properties

- Violating foreign ownership restrictions can result in fines up to S$20,000, imprisonment for up to three years, or both.

- Failure to update changes regarding property ownership with IRAS can incur fines up to S$5,000.

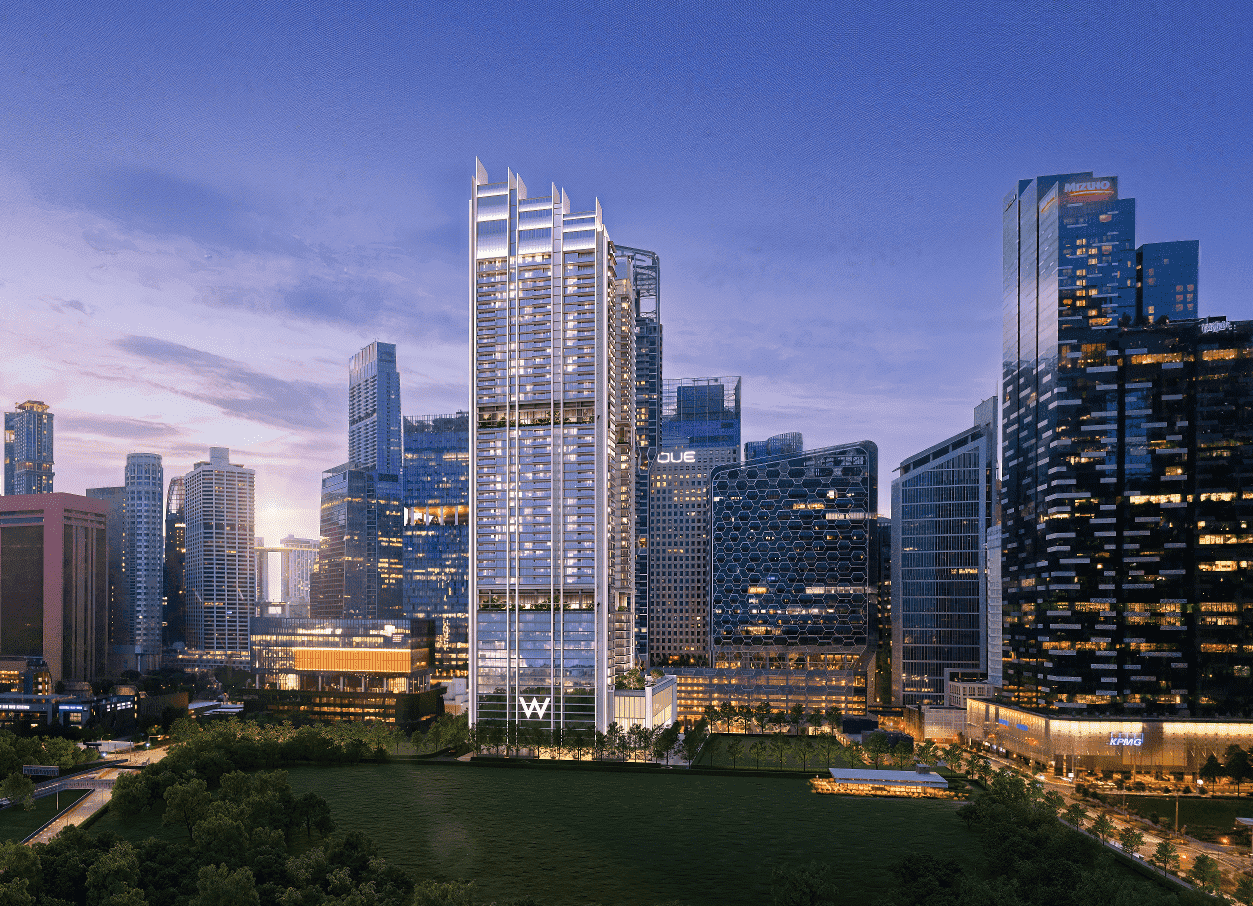

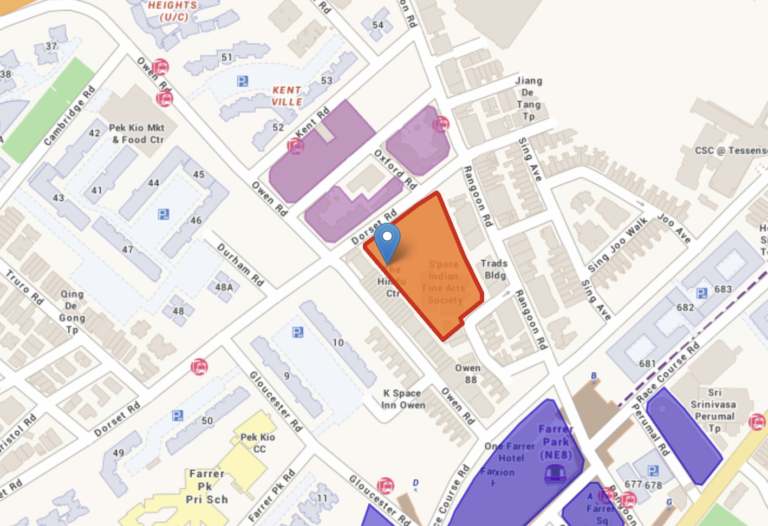

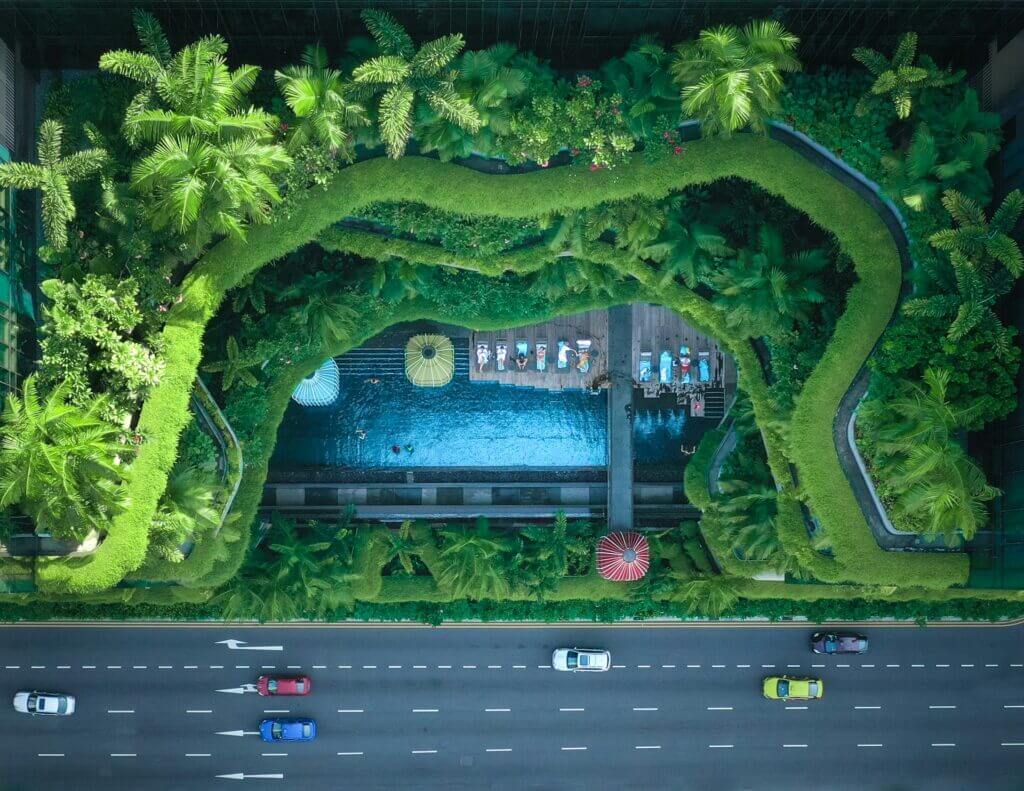

upcoming Condos

Hurry—prime units vanish fast! Secure your showflat appointment now!

Conclusion

Navigating property ownership in Singapore requires careful planning, especially for married couples looking to own both an HDB flat and a private condominium. By understanding the regulations, structuring ownership wisely, and ensuring compliance with all laws, you can successfully manage your property investments.

If you’re considering this venture, stay informed and consult with professionals as needed. This will help you avoid pitfalls and take full advantage of the opportunities available in Singapore’s housing market.