Navigating the world of property ownership in Singapore can be complex, especially when it comes to using your Central Provident Fund (CPF) savings. If you’re a Singapore citizen considering purchasing a condo while still owning an HDB flat, you’re in the right place.

This guide will walk you through the essential steps and considerations, ensuring you make informed decisions.

Understanding the Basics: Can You Use CPF for a Condo Downpayment?

Yes, you can utilize your CPF Ordinary Account (OA) savings for the downpayment of a condo, even if you own an HDB flat. However, there are specific conditions you need to meet. Let’s break it down step by step.

1. Fulfilling the Minimum Occupation Period (MOP)

What is MOP?

- Requirement: Before purchasing a private property, you must fulfill the Minimum Occupation Period (MOP) of 5 years for your HDB flat.

- Calculation: The MOP starts from the key collection date of your HDB flat until you exercise the Option to Purchase (OTP) for the private property.

2. Citizenship and Ownership Rules

Who Can Own Both Properties?

- Singapore Citizens: As a citizen, you can own both an HDB flat and a private property at the same time without needing to sell your HDB.

- Singapore Permanent Residents (SPRs): If you’re an SPR, you must sell your HDB flat within six months of buying a private property.

3. CPF Usage for Downpayment

How Much Can You Use?

Initial Downpayment Breakdown

- Cash Requirement: You need to pay at least 5% of the purchase price in cash.

- CPF OA Contribution: The remaining 20% of the downpayment can be covered using your CPF OA savings, provided your account has enough funds.

4. Additional Payments and Stamp Duties

Understanding Stamp Duties

What You Need to Know

- Buyer’s Stamp Duty (BSD): This duty applies to all property purchases and must be settled within 14 days of signing the Sale and Purchase Agreement (S&P). Initially, this payment should be made in cash but can later be reimbursed from your CPF OA.

- Additional Buyer’s Stamp Duty (ABSD): If you’re a Singapore citizen buying a second residential property, you’re subject to a 20% ABSD. Similar to BSD, this must also be paid in cash upfront, with reimbursement possible from your CPF OA afterward.

5. Monthly Mortgage Repayments

Using CPF for Monthly Payments

After making the initial downpayment, you can continue using your CPF OA savings to cover monthly mortgage repayments for your condo. This can significantly ease the financial burden on your cash flow.

6. Financial Planning and Considerations

Key Ratios to Keep in Mind

Loan-to-Value (LTV) Ratio

- First Loan: If you have no outstanding housing loans, your LTV ratio can be as high as 75%.

- Second Loan: If you already have one outstanding loan (for your HDB flat), this drops to 45%.

Total Debt Servicing Ratio (TDSR)

- TDSR Limit: Ensure that your total monthly debt obligations do not exceed 55% of your gross monthly income. This includes any mortgages for both your HDB flat and condo.

7. Strategic Considerations

Smart Moves to Consider

Decoupling Strategy

- What is Decoupling?: This involves one spouse transferring their share of the HDB flat to the other spouse. It allows the first spouse to purchase a private property without incurring ABSD.

- Considerations: Be mindful that legal fees and stamp duties are involved in this process.

Renting Out Your HDB Flat

- Permission Required: After acquiring a private property, you’ll need to seek permission from HDB to rent out your flat.

- Rental Yield: Analyze the potential rental income from your HDB flat to see if it can cover or exceed the mortgage payments of your new property.

Consulting with real estate professionals and financial advisors can offer tailored guidance specific to your situation.

Summary Table

| Criteria | Details |

|---|---|

| Minimum Occupation Period (MOP) | 5 years from key collection to OTP/S&P date |

| Citizenship | Only Singapore citizens can own both HDB and private property concurrently |

| Downpayment | 25% of purchase price (5% in cash, 20% in CPF OA/cash) |

| Stamp Duties | BSD and ABSD must be paid in cash first; can be reimbursed from CPF OA |

| Monthly Mortgage Repayments | CPF OA can be used for monthly repayments |

| Loan-to-Value (LTV) Ratio | Up to 75% for first loan; 45% for second loan |

| Total Debt Servicing Ratio (TDSR) | Monthly debt obligations ≤ 55% of gross monthly income |

| Strategic Considerations | Decoupling, renting out HDB flat |

By understanding these criteria, you can effectively manage the process of using CPF for the downpayment of a condo while continuing to own an HDB flat in Singapore. Happy home hunting!

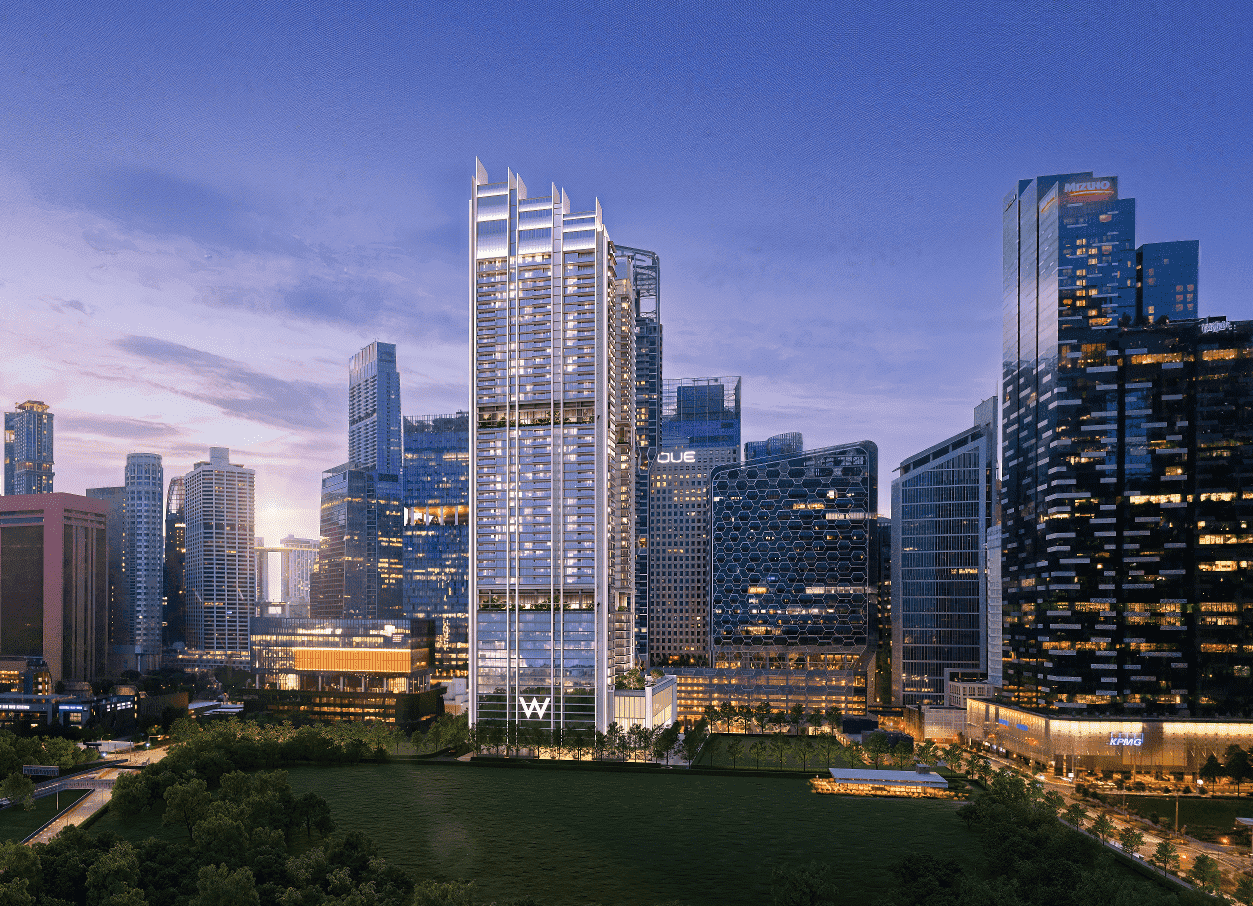

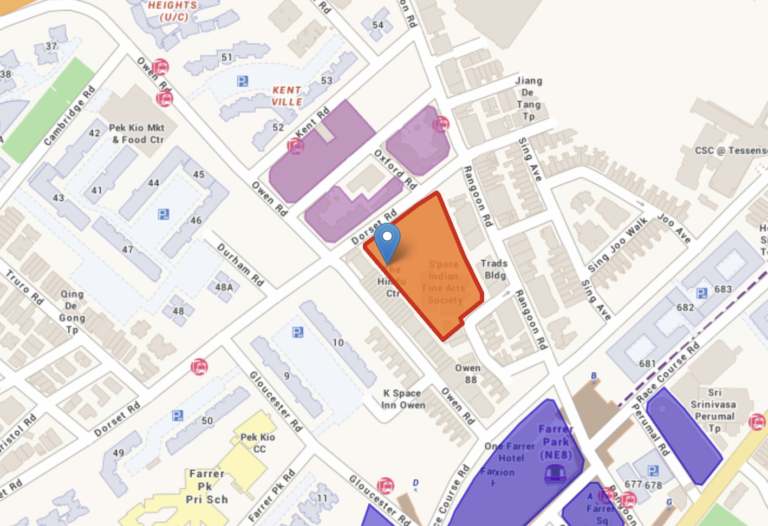

upcoming Condos

Hurry—prime units vanish fast! Secure your showflat appointment now!

Conclusion

Utilizing CPF savings for the downpayment of a condo while still owning an HDB flat is indeed feasible for Singapore citizens who have met the MOP requirement. However, careful financial planning and a clear understanding of regulations are essential to make this dual ownership work effectively.