Choosing the right condo insurance policy in Singapore is crucial to ensure your home and belongings are well-protected. With numerous options available, it’s essential to compare different policies to find the best coverage for your needs.

Here’s a step-by-step guide on how to compare condo insurance policies effectively.

Identify Your Coverage Needs

Building Coverage

Ensure the policy covers the structure of your condo, including walls, floors, and built-in fixtures. This is essential for protecting the physical integrity of your home.

Home Contents Coverage

Look for coverage that protects your personal belongings such as furniture, electronics, and appliances. This coverage is vital to replace or repair your possessions in case of damage or theft.

Renovation Coverage

If you have made improvements or renovations, ensure these are covered. This protects the added value and enhancements you’ve made to your home.

Liability Coverage

This protects you if someone is injured in your condo and you are found legally responsible. It can cover medical expenses and legal fees, providing peace of mind in case of accidents.

Compare Key Features

Coverage Limits

Building Coverage

Check the maximum amount the policy will pay for damage to the building structure. Ensure it aligns with the replacement cost of your condo.

Contents Coverage

Compare the limits for personal belongings and ensure it’s sufficient for your valuables. Higher limits offer better protection for your possessions.

Renovation Coverage

Ensure the policy covers the full value of your renovations. This is crucial for safeguarding the investments you’ve made in your home.

Liability Coverage

Higher limits provide better protection against potential lawsuits. Evaluate the level of coverage based on your personal risk assessment.

Premiums

Annual Premiums

Compare the cost of premiums across different policies. Ensure you understand what is included in the premium and any additional costs. Balance affordability with the level of coverage provided.

Exclusions and Deductibles

Exclusions

Review what is not covered by the policy. Common exclusions might include certain natural disasters or specific types of damage. Understanding exclusions helps avoid surprises during claims.

Deductibles

The amount you need to pay out-of-pocket before the insurance kicks in. Lower deductibles mean higher premiums and vice versa. Choose a deductible that balances affordability with financial security.

Additional Benefits and Services

Emergency Assistance

Some policies offer 24/7 emergency services for plumbing, electrical issues, locksmith services, etc. This can be highly beneficial during unexpected emergencies.

Temporary Accommodation

Coverage for temporary living expenses if your condo becomes uninhabitable due to a covered event. This ensures you have a place to stay while repairs are being made.

Home Assistance Services

Access to handyman services, pest control, or air-conditioner repair. These added services can make a significant difference in maintaining your home.

Compare Policies from Different Providers

AIG Singapore

- Plans: Homes Advantage Package, Homes Complete

- Features: Comprehensive building and contents cover, 24/7 emergency home assistance services, coverage for fine homes, jewelry, and valuables.

Income

- Plan: Enhanced Home Insurance

- Features: Coverage for home contents, fire, theft, renovations, liability, and 24/7 emergency assistance.

FWD

- Plan: Home Insurance for Condominium

- Features: Optional building coverage, up to S$60,000 for household contents, and S$500,000 personal liability.

MSIG

- Plan: Enhanced HomePlus

- Features: Comprehensive coverage with optional add-ons, up to S$50,000 for contents, and S$1,000,000 personal liability.

Policies Comparison Table

| Insurance Provider | Plan Name | Building Coverage | Contents Coverage | Liability Coverage | Annual Premium |

|---|---|---|---|---|---|

| AIG | Homes Advantage Package | S$85,000 | S$20,000 | S$1,000,000 | S$183.20 |

| Income | Enhanced Home Insurance | S$100,000 | S$150,000 | S$400,000 | S$68.18 |

| FWD | Home Insurance – Condo | Optional | S$60,000 | S$500,000 | S$91.13 |

| MSIG | Enhanced HomePlus | Optional | S$50,000 | S$1,000,000 | S$96.79 |

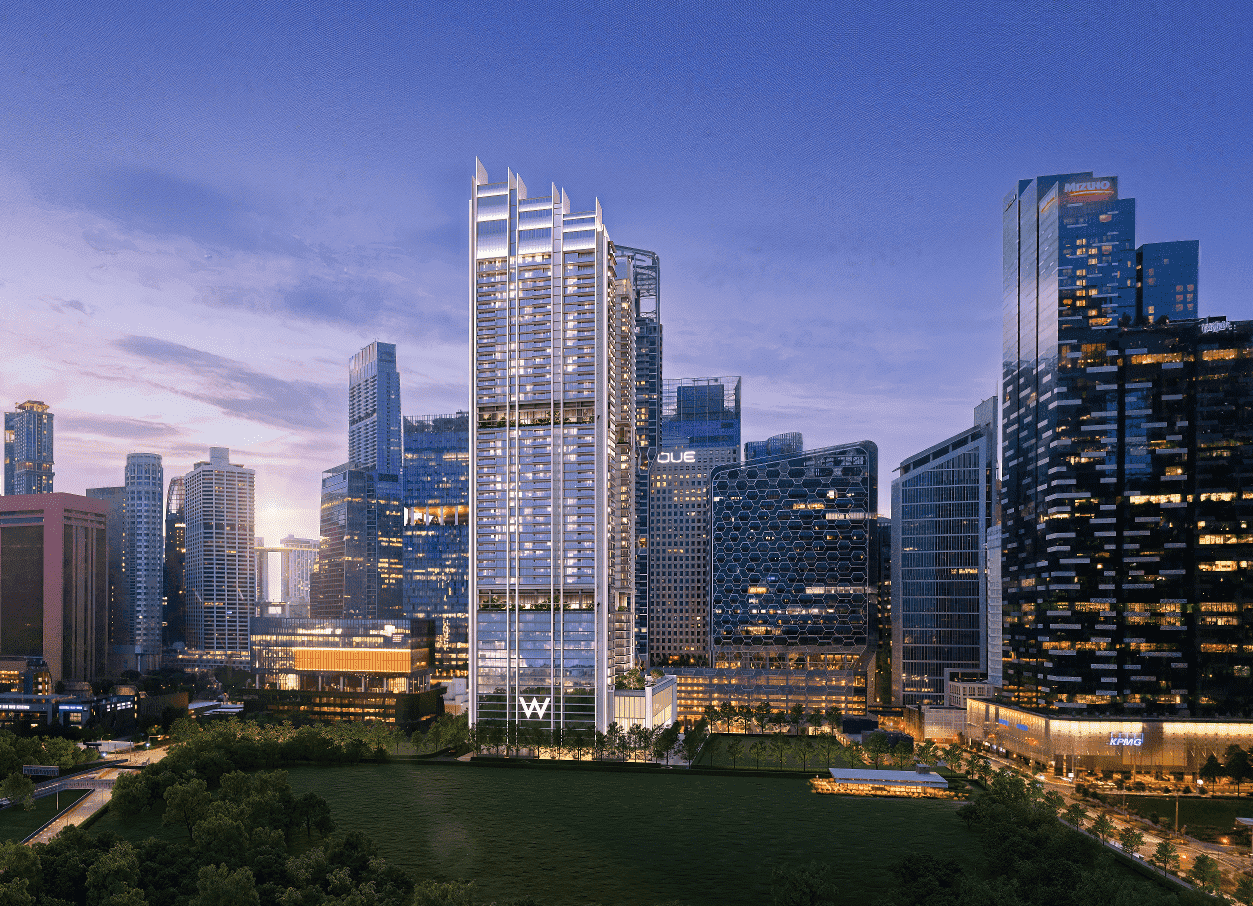

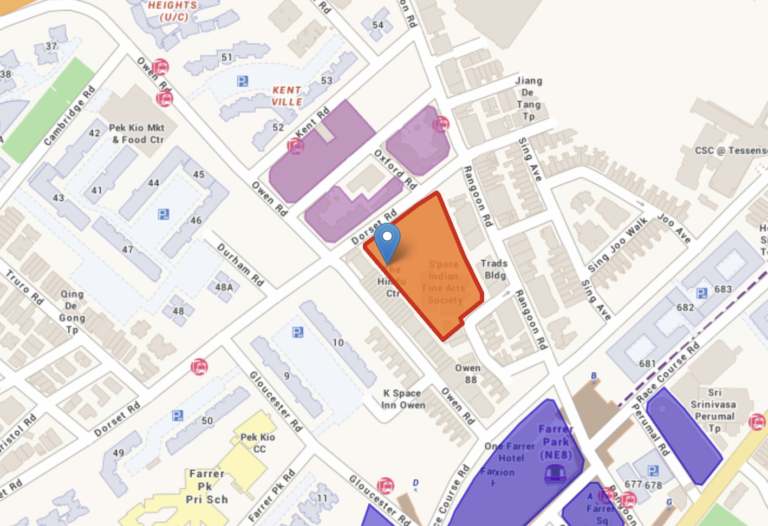

upcoming Condos

Hurry—prime units vanish fast! Secure your showflat appointment now!

Comparison

Here’s a detailed comparison of some policies based on the information from MoneySmart and Seedly:

| Provider | Plan | Building Coverage | Contents Coverage | Personal Liability | Annual Premium | Discounts/Promotions |

|---|---|---|---|---|---|---|

| AIG | Homes Advantage Package | S$85,000 | S$20,000 | S$1,000,000 | S$183.20 | Up to S$70 Cash via PayNow |

| FWD | Home Insurance – Condominium | Optional | S$60,000 | S$500,000 | S$91.13 | 30% off, chance to win an Apple iPhone 15 |

| MSIG | Enhanced HomePlus – Standard | Optional | S$50,000 | S$1,000,000 | S$96.79 | S$10 Cash via PayNow, GrabRide e-vouchers |

| Tiq | Home Insurance – Condominium | S$300,000 | S$50,000 | S$1,000,000 | S$144.75 | 20% off, S$20 eCapitaVoucher |

Conclusion

By carefully comparing the coverage options, premiums, and additional benefits of different condo insurance policies, you can choose the one that best meets your needs and provides comprehensive protection for your home. Use comparison tools and read reviews to make an informed decision. With the right condo insurance, you can enjoy peace of mind knowing that your home and belongings are well-protected.