Many people dream of owning a condo, but the question that often arises is whether or not they can afford it. Buying a condo is a significant investment, and it’s essential to know if you have the financial means to make it happen.

Factors that determine whether or not someone can afford a condo include their income, credit score, and debt-to-income ratio. It’s important to understand that buying a condo involves more than just the down payment and mortgage payments. There are also additional costs such as property taxes, insurance, and maintenance fees that should be factored into the budget.

Fortunately, there are tools available such as affordability calculators that can help prospective buyers determine how much they can afford to spend on a condo. These calculators take into account various factors such as income, expenses, and debt to provide an estimate of how much a person can afford to spend on a condo. With the right information and resources, anyone can determine whether or not they can afford a condo and make their dream of homeownership a reality.

Understanding Condo Affordability

Assessing Your Financial Health

Before considering purchasing a condo, it is essential to assess your financial health. This involves taking a closer look at your income, debt obligations, and budget. By doing so, you can determine whether you can afford a condo and what type of condo you can afford.

Income and Debt Obligations

Your income and debt obligations are two crucial factors that determine your condo affordability. Your monthly income plays a significant role in determining how much you can afford to spend on a condo. On the other hand, your monthly debt obligations, such as car loans, credit card payments, and personal loans, will reduce the amount of money you have available to spend on a condo.

The Total Debt Servicing Ratio (TDSR) Framework

The Total Debt Servicing Ratio (TDSR) framework is a measure used by financial institutions to assess a borrower’s ability to repay a loan. It is a ratio of the borrower’s total monthly debt obligations to their gross monthly income. The TDSR framework is an essential factor in determining whether you can afford a condo.

Under the TDSR framework, your monthly debt obligations should not exceed 60% of your gross monthly income. This includes all your debt obligations, including your mortgage repayment. Therefore, it is crucial to consider your monthly debt obligations when determining your condo affordability.

In conclusion, understanding condo affordability requires assessing your financial health, including your income, debt obligations, and budget. The TDSR framework is an essential factor in determining your condo affordability, and your monthly debt obligations should not exceed 60% of your gross monthly income. By taking a closer look at these factors, you can determine whether you can afford a condo and what type of condo you can afford.

Financing Your Condo Purchase

When buying a condo in Singapore, financing is a crucial factor to consider. Most buyers will require a bank loan to finance their purchase, and understanding the loan process can help you make informed decisions.

Securing a Bank Loan

To secure a bank loan, you will need to undergo a credit assessment to determine your creditworthiness. This assessment takes into account your income, credit history, and debt-to-income ratio, among other factors. It is important to note that different banks may have different criteria for approving loans, so it is advisable to shop around and compare loan packages.

Understanding Loan-to-Value (LTV) Limits

The loan-to-value (LTV) limit is the maximum amount a bank can lend you based on the purchase price or market value of the property, whichever is lower. The LTV limit is set by the Monetary Authority of Singapore (MAS) and varies depending on the property type and loan tenure. For example, the LTV limit for a second property is lower than that for a first property.

Calculating Downpayment and Stamp Duty

When buying a condo, you will need to pay a downpayment and stamp duty. The downpayment is the amount you need to pay upfront, and it is usually a percentage of the purchase price. The minimum cash downpayment is 5% for the first property and 25% for the second property. The stamp duty is a tax on the property transaction, and it varies depending on the purchase price and buyer’s stamp duty rates.

To calculate the downpayment and stamp duty, you can use online calculators or consult with a property agent. It is important to factor in these costs when budgeting for your condo purchase, as they can significantly affect your finances.

In summary, financing a condo purchase in Singapore involves securing a bank loan, understanding loan-to-value limits, and calculating the downpayment and stamp duty. It is important to do your research and compare loan packages to find the best mortgage rates and home loan package for your needs.

Additional Costs and Considerations

Property Taxes and MCST Fees

When purchasing a condominium in Singapore, it is important to consider the additional costs beyond the purchase price. Property taxes and MCST (Management Corporation Strata Title) fees are two such costs that should be taken into account. Property taxes are calculated based on the annual value of the property. The annual value is determined by the Inland Revenue Authority of Singapore (IRAS) and is based on the estimated gross annual rent of the property if it were to be rented out. MCST fees, on the other hand, are paid to the management corporation of the development and cover the costs of maintaining the common areas and facilities of the development.

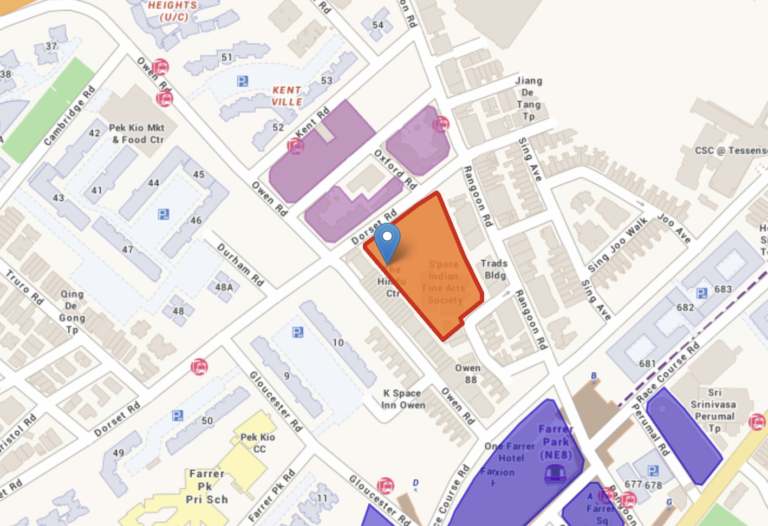

Impact of Property Value and Location

The location and value of the property can also impact the additional costs associated with owning a condominium in Singapore. Properties located in the Core Central Region (CCR) tend to have higher property taxes and MCST fees due to their prime location. Similarly, higher-priced properties generally have higher property taxes and MCST fees. It is important to factor in these additional costs when determining the affordability of a condominium.

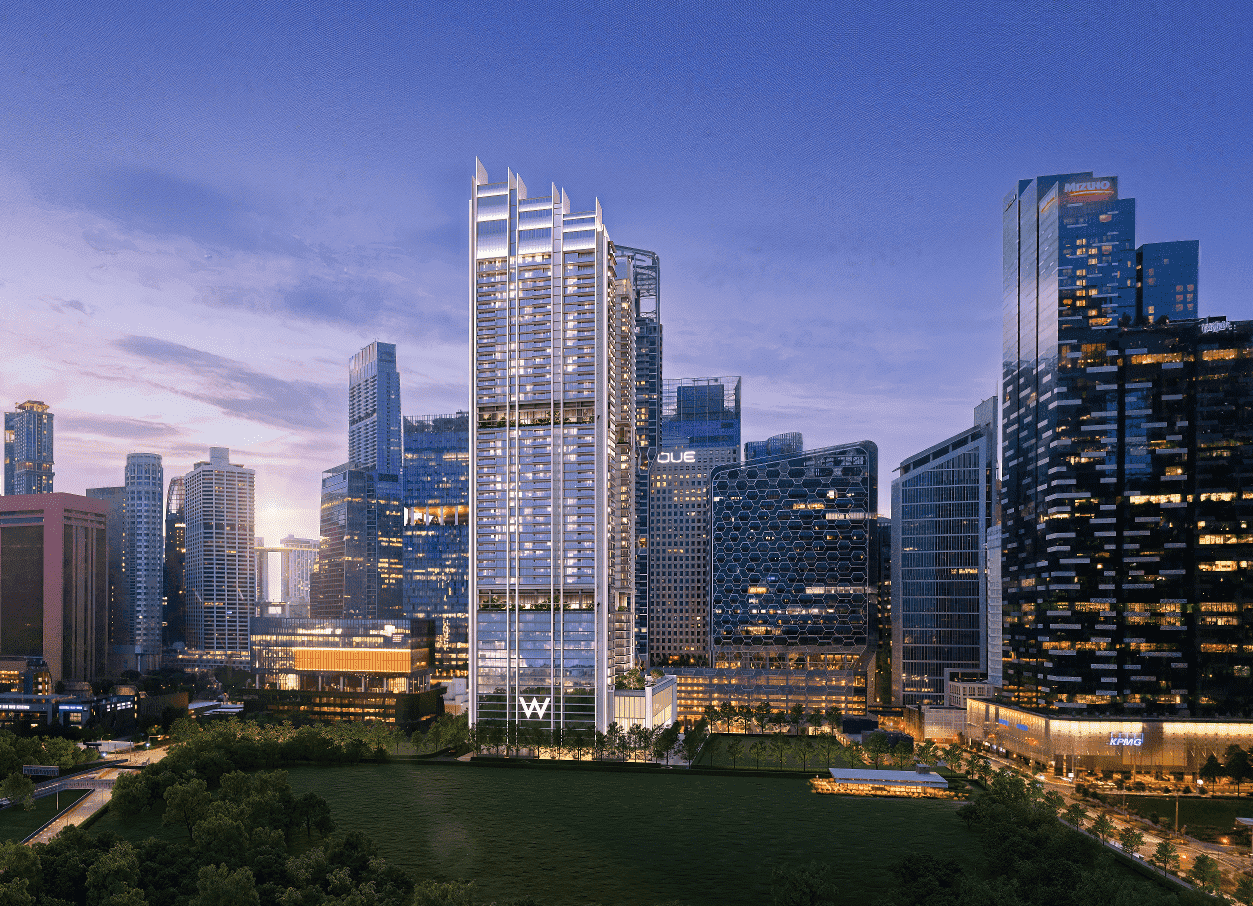

upcoming Condos

Hurry—prime units vanish fast! Secure your showflat appointment now!

Planning for Future Expenses

Beyond property taxes and MCST fees, there are other future expenses to consider when owning a condominium in Singapore. These expenses could include repairs and maintenance, upgrading of facilities, and replacement of equipment. It is important to plan for these expenses and to have a sufficient cash flow to cover them. CPF savings can be used to pay for some of these expenses, but it is important to note that there are eligibility criteria that must be met.

When purchasing a condominium in Singapore, it is important to consider all of the additional costs and considerations beyond the purchase price. By factoring in property taxes, MCST fees, property value, and location, as well as planning for future expenses, potential buyers can make an informed decision on the affordability of a condominium.